This blog gives a deeper dive into the themes brought up in my previous blog on Eight things you can do to make your business more profitable – 4. Tighten your management of debtors.

Why give credit?

The fundamental principle is that you give credit to win and grow you business. Keep this at the back of your mind. Customers can be tricky. They may use credit granted by one supplier to help get them fund the business with another or for something totally different altogether.

We know that if we want to make a sale we often have to give credit. This may be because the balance of power is tilted in favour of the customer or because it is standard practice in the industry you are in.

Sales negotiations are not just about price. If you raise credit early in the discussion you will be amazed at what is possible. If you raise it after all other details have been negotiated then you are unlikely to see any flexibility.

There will be circumstances when you should not grant credit. If the customer has no track record or a poor credit history or low credit score. In these situations you would be in your rights to demand CBD or COD(cash before/on delivery).

Why is credit management so critical to the success of my business?

Businesses fail or are lack the funds to do what they need to do because of poor credit management. All businesses need to have strong credit management policies. Why?

- You have to pay the cost of funding it. This can be expensive – factoring can easily cost 15% of loaned amount (on an annualised basis). Cash tied up in credit cannot be used for growth or other initiatives.

- If you don’t address issues promptly you may have far greater losses as you continue to provide goods or services long after you should have taken action. What would have been a £10,000 loss can easily grow into a £20,000 or £30,000 loss.

- Losses go straight to the bottom line – you have to sell far more just to get back to where you started. If your Gross Profit (sales less all costs of the sale including shipping and commissions) is 25%, you will need to sell an additional £40,000 to make up for a £10,000 bad debt.

- It is a waste of time and management focus – well established credit procedures allow you to keep on top of credit. Once allowed to slip it takes a disproportionate amount of work to bring back under control

- You are likely to have nasty surprises. When problems surface you often find that you need to make significant write offs. Additionally if you are relying on that payment then you may not be able to meet your own commitments which can have serious consequences.

- It can poison your relationships with customers. Your conversations with your customers should be about how to develop the business not when you are going to be paid. Customers with a poor credit history with you will tend to feel guilty. As a rule people tend to avoid situations that make them feel guilty so … they are far more likely to work with somebody else.

How do I know if I have a problem?

A quick checklist.

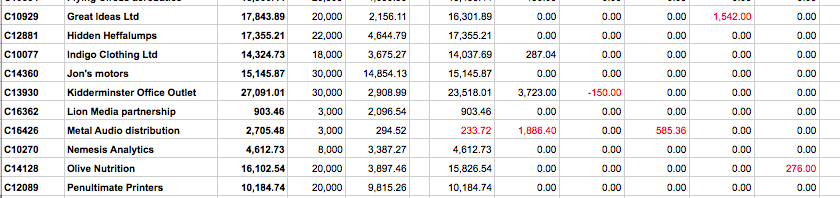

- Do you produce a monthly (or weekly) aged debtors report? (see main image)?

- Do you review it each month (week)?

- Is most of the debt in the first column (Not Due) with little if any more than 30 days overdue?

- Do you know the reason for everything not in the first two columns?

- Do you have an action plan to make sure that you can get the money back?

- Do you check progress against the action plan and make people accountable?

If your answers to any of these questions is “No” you probably have a problem.

So how can I manage credit better?

The foundations of any good credit policy are your Terms of Sale (or Sales Contract). Make sure it includes the following points:

- Retention of Title – Ownership of goods or IP lies with you until the customer has paid

- Payment terms (when debt becomes due) and Credit Limit are clearly shown

- Customer is liable for debt recovery costs.

- Interest to be charged on overdue invoices and interest rate to be used.

- Receipt of goods or services – customer is responsible for raising any issues with quality of goods or services within a few days of receipt. Customer is responsible for signing POD at time of delivery.

- The Customer agrees to carry out reconciliations of account regularly and ad hoc if required.

- Customer must provide remittance or payment advice to notify allocation of payments made to invoice/credit note received. In the absence of this FIFO will be used (ie payments used to settle oldest outstanding debts first).

- Process for management and agreement of credit notes – can be a big issue with larger customers.

- Acceptable payment methods including agreement as to when payment has been received – eg cheques to have cleared.

You have two controls available to manage credit on an on going basis:

Credit terms – the number of days after invoice date that payment becomes due. These are normally set by industry practice.

Credit limit – the maximum amount of credit that you are prepared to extend to a customer. This depends on an assessment of risk (eg past experience, use of credit rating agencies) and size of business.

A good ERP or order management system will check both of these automatically as you enter orders. It can be set to warn or to block these orders from processing further. It is then up to you whether you choose to release or not.

Circumstances may require you to provide flexibility on either credit terms or credit limit (see section on exceptions). Relaxing both at the same time is almost always dangerous.

What else do I need to do?

You need to be scrupulous in your paperwork – don’t give your customer any excuse to delay or refuse payment.

- Make sure you put details of customer PO (Purchase Order) on your delivery note and invoice. Sometimes customers will not pay if there is not a valid PO.

- Send a delivery note with each shipment.

- Get a signed POD (Proof of Delivery) for all shipments. If you are providing services have your customer to confirm receipt of services as stipulated (for example signing off each stage of a project). If not agree with them what you have to do to remedy the situation.

If your customer pays monthly, send a statement showing what they owe a week before their payment run. Follow up with the customer to confirm they will be paying this amount. This will flush out any problems. They may say they don’t have a POD or claim that some goods were missing and use this as an excuse to not pay anything. I have seen too many cases where a major customer has delayed payment in this way.

Carry out regular reconciliations with customers to make sure that you both agree what is outstanding (at an invoice level). How often you do this depends on the size and complexity of your dealings with the customer. You may choose every month for larger or more complex customers and once a year for the rest. If you fail to do this you will almost certainly have far more work at a later stage, weaken your position if you need to take legal action and more often than not find yourself writing off the difference between what they say they owe you and what you know they owe you.

Have a standard process for dealing with overdue debts. For example if a debt is 10 days overdue you call, if over 20 days overdue you may stop shipment, if 30 days overdue you may start threatening legal action. Keep records of all communication – time, date, who you spoke to, what was agreed etc.

My customers aren’t paying on time, what can I do?

Have a credit exception policy. There are always going to be times when a customer is not able to pay on time. You need to find out as early as possible that a customer is experiencing issues. That way you both have more options for managing the situation.

Tip – Aim to link the granting of an exception to some benefit to you. They are getting a benefit from you and so should be prepared to give something in return. This has the side effect of putting a price on not paying on time. This will magically reduce the number of exceptions you have to deal with

The first step is to speak to the customer to understand the reason and whether it is a one off short-term cash flow issue or something more serious. In order of increasing severity you have the following options:

- Ignore it – not a great idea unless short term exception and the amounts are not large.

- Payment plan – agree with the customer what they will pay and when until they are back within terms. In general such a plan will include:

- Payment before shipment – you can require that customer pays before you ship (or manufacture) any fresh orders. This keeps the absolute size of debt unchanged but refreshes the age of the debt.

- Stop supply – if it is obvious the customer is unable or unwilling to pay then it may be necessary to cease supply of goods or services.

- Legal action – use this as a last resort. In most cases the threat of legal action will result in payment. Some customers wait until just before the case comes up in court to pay.

- Initiate proceedings to wind up the company – if all of the above don’t work then this may be the only option open to you. In general as an unsecured creditor you are unlikely to recover the debt in full.

Be clear who can approve credit exceptions – for smaller companies it should probably be the MD or FD or both.

Who should be responsible for managing credit?

Great question and one that many people don’t ask. Many companies will give Sales this responsibility. Not smart. Sales people are targeted and rewarded on the level of sales they make. Credit control tends to be seen as something that gets in the way of them achieving their targets.

In general the best place to put credit management is Finance or Customer Service (if not part of Sales). At the same time involve the Sales team in the management of credit. That way you are making credit decisions – terms, limits, actions – with an understanding of commercial factors – customer development plans, special considerations etc – rather than blindly following a policy.

Tip – If you can link Salesperson commissions to money received on the basis that “a sale is not a sale until the money is in the bank”. This can be done by freezing commissions on sales that are more than say 30 days overdue. This aligns the interests of Sales and the company.

You may also find the advice given by the Federation of Small Businesses useful in their February/March 2013 edition of First Voice